Accounting Manager

Accounting Manager

Driving Resource Usage Efficiency

As users and organizations receive feedback about their usage or even get charged for it, their usage behavior inevitably changes to drive improved overall efficiency. Accounting Manager is a fast, easy-to-use accounting management system that allows showback and chargeback for usage tracking and charging for resource or service usage in virtually any computing environment.

- Track usage per user, group, project, or account

- Pre-pay or pay-as-you-go models

- Charge rates per resource, action, or quality of service

- Lien-based model

- Enforce budgets

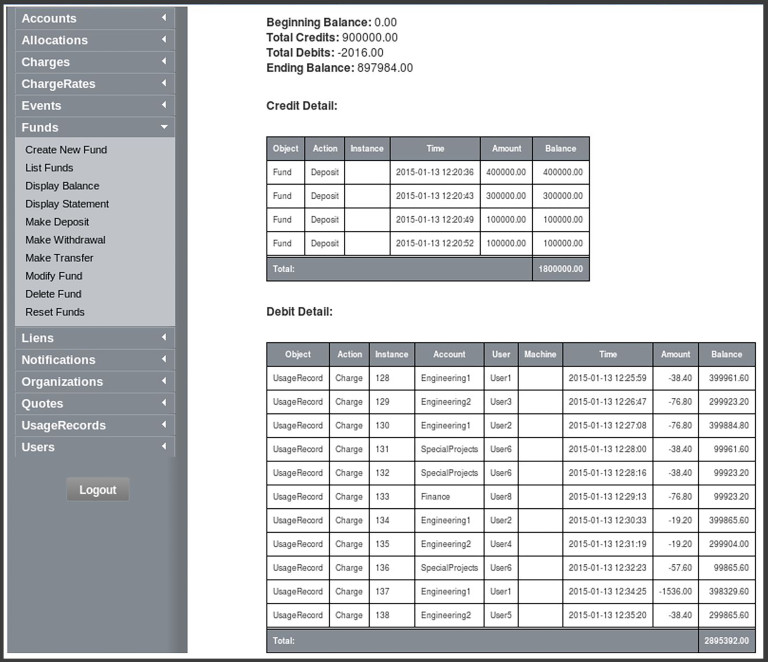

It acts much like a bank in which credits are deposited into funds with constraints designating as to which entities may access the funds. As resources or services are utilized, funds are charged and usage recorded. It supports familiar operations such as deposits, withdrawals, transfers, and refunds. It provides balance and usage feedback to users, groups, and accounts, as well as reports and controls to managers and system administrators.

Ease of Use Driven Productivity

Since accounting and billing models vary widely from organization to organization, Accounting Manager has been designed to be extremely flexible, featuring customizable usage and fund configurations, and supporting a variety of tracking, charging and allocation models. Attention has been given to scalability, security, and fault tolerance.

- Tracking and Reporting – Accounting Manager tracks and reports system usage by each user, group, or account, for showback or pay-for-use chargeback.

- Price and Rate Setting – Use accounting to fit your needs with Accounting Manager’s diverse price-setting and charging styles. Set prices/rates per resource type (e.g. processor speed, SSD vs traditional disk, etc), per action (PS-enabled, e.g. GB transferred to Cloud), per location (e.g. Local vs. Cloud A vs. Cloud B), or per service level (e.g. higher for run-immediately preemptive workloads and less for low priority preemptible workloads). Use the Standard Charging style for tasks with unknown and fixed sizes and durations, or the Incremental/Periodic Charging style for ongoing services and elastic workloads.

- Budget Setting – Govern behavior by setting usage budget amounts per user, account, or organization. Accounting Manager can also set budgets per year, quarter, or month. Alternatively, use a no-charge service level, instead constraining priority, location, preemptibility, etc.

- Quoting – Allow users or services to see how much their usage request would cost. This will help them to make a correct selection or to identify if sufficient funds are available to fulfill the usage request.

- Enforcement – Control usage with either showback (tracking of usage), non-enforced charging (notional charging with no budgets), or with strict-allocation budgets (based on debits against budgets). Use lien-based enforcement to avoid charging race conditions or strict enforcement of budgets.

- Policies – Charge based on workload performance such as what is blocked or reserved vs. used vs. used successfully. Also, set policies for payment time, such as pay upfront, pay after, or allow overdrafts with credit limits.

Accounting Manager utilizes advanced and flexible controls that enable administrators to create resource-efficient user behavior. Reclaim wasteful spending and put savings where they belong – reinvested for achieving improved results.